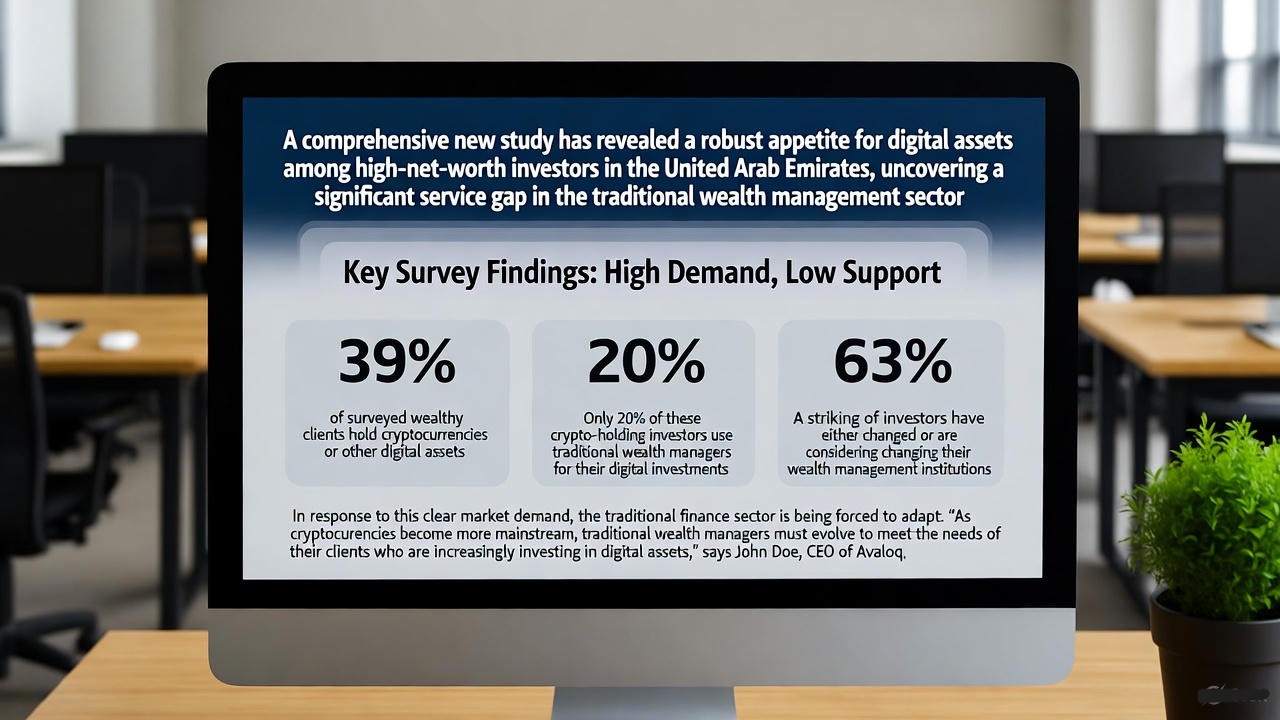

A new study reveals critical data on UAE digital asset demand, showing that 39% of high-net-worth investors hold cryptocurrencies while traditional wealth managers struggle to provide adequate services. This significant gap is causing widespread client dissatisfaction across the Emirates.

Survey Reveals Extent of UAE Digital Asset Demand

The comprehensive study, conducted by Swiss software firm Avaloq between February and March 2025, surveyed 3,851 investors and 456 wealth management professionals. The research provides clear metrics showing the strength of UAE digital asset demand among affluent clients.

Key findings include:

-

39% of surveyed wealthy UAE investors hold digital assets

-

Only 20% use traditional wealth managers for these investments

-

63% have changed or are considering changing wealth management firms

Wealth Management Crisis Emerges

The growing UAE digital asset demand has created a crisis for traditional wealth managers. With nearly two-thirds of clients considering switching firms due to poor crypto support, financial institutions face significant client retention challenges.

The primary issues driving this dissatisfaction include:

-

Lack of digital asset expertise among relationship managers

-

Insufficient educational resources for clients

-

Limited investment vehicles for crypto exposure

-

Inadequate portfolio management tools for digital assets

Industry Responds to Investor Demand

Financial institutions are now scrambling to address the overwhelming UAE digital asset demand. According to Akash Anand, Avaloq’s head for the Middle East and Africa, “We’re seeing unprecedented pressure on wealth managers to develop comprehensive digital asset services. Clients are no longer willing to accept excuses about regulatory uncertainty or market volatility.”

Major developments in the sector include:

-

New digital asset divisions within traditional banks

-

Partnerships with crypto-native companies

-

Enhanced training programs for wealth advisors

-

Development of Sharia-compliant digital products

Future Outlook for Digital Assets in UAE

The strong UAE digital asset demand shows no signs of slowing, with several factors driving continued growth:

-

Clear regulatory framework from UAE authorities

-

Growing institutional acceptance of digital assets

-

Increasing retail investor interest

-

Strategic national initiatives toward digital economy

As traditional wealth managers race to catch up with client expectations, the landscape of wealth management in the UAE is undergoing fundamental transformation. The institutions that successfully address this UAE digital asset demand will likely capture significant market share in the coming years.

Disclaimer: This article is based on a third-party study and is for informational purposes only. It does not constitute financial advice or an endorsement of any investment strategy.