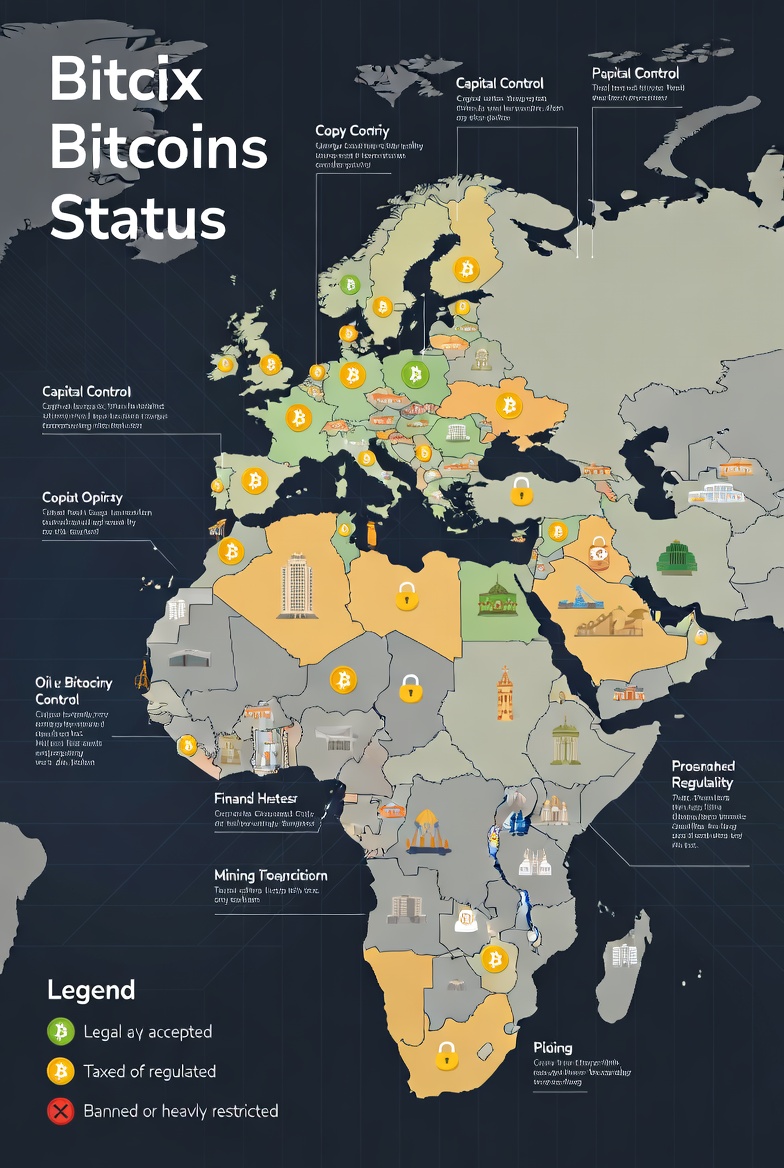

Bitcoin’s legal status varies widely across the world. While some countries fully embrace it as a legitimate digital asset, others restrict or ban its use. Understanding the laws in your country is essential before buying, selling, or using Bitcoin.

Bitcoin Is Legal in Many Countries

In countries like the United States, Canada, the United Kingdom, and most of Europe, Bitcoin is legal. Residents can buy, sell, hold, and use Bitcoin for payments. Exchanges and crypto platforms operate under government regulations, including anti-money laundering (AML) and Know Your Customer (KYC) rules.

These countries often treat Bitcoin as property or an investment asset rather than official currency. For example:

- In the US, the Internal Revenue Service (IRS) classifies Bitcoin as property. Profits from selling or trading Bitcoin are subject to capital gains tax.

- In the UK, Bitcoin is treated as a taxable asset. Gains from selling Bitcoin may be taxed, and businesses accepting Bitcoin must comply with financial regulations.

Countries with Restrictions

Some countries allow Bitcoin but heavily regulate its use. For example:

- India – Bitcoin is legal to own and trade, but the government has imposed taxes and restrictions on cryptocurrency businesses.

- Japan – Bitcoin is legal and recognized as a digital payment method, but exchanges must be registered and comply with strict regulations.

Countries That Ban Bitcoin

A few countries have declared Bitcoin illegal or have banned trading and usage. Reasons include preventing money laundering, fraud, and loss of control over monetary policy. Examples include:

- China – Cryptocurrency trading and exchanges are banned, though owning Bitcoin is not technically illegal. Mining is also heavily restricted.

- Algeria, Morocco, and Bangladesh – Bitcoin use is banned completely, and citizens may face legal penalties for trading or using it.

Key Legal Considerations

- Taxes – In many countries, profits from Bitcoin are subject to taxes. Always check local tax regulations.

- Exchanges – Use only regulated and legally compliant exchanges to avoid problems with authorities.

- Payment Acceptance – Businesses accepting Bitcoin must follow financial and legal rules in their country.

- AML and KYC – Most countries require exchanges to verify users’ identities to prevent illegal activities.

Conclusion

Bitcoin is legal in most countries, but its status differs depending on local laws and regulations. Some countries fully embrace it, some regulate it strictly, and a few ban it entirely. In 2026, anyone looking to invest, trade, or use Bitcoin should carefully check their country’s laws and comply with regulations to avoid legal issues.

If you want, I can also create a world map showing Bitcoin’s legal status country by country for easier understanding. It would be a very clear visual guide for your website readers.