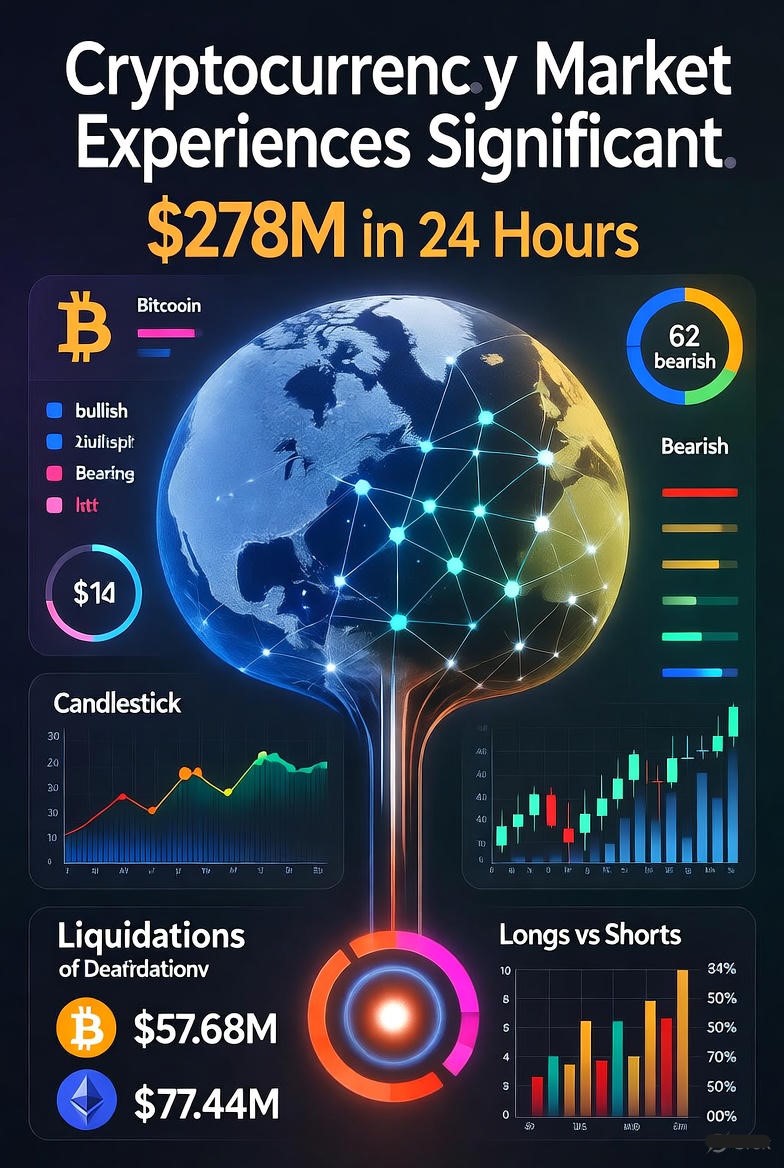

The cryptocurrency market experienced significant turbulence during the past 24 hours, with leveraged positions worth $278 million being liquidated across major exchanges. Data from CoinAnk reveals that long positions bore the brunt of the market movement, accounting for $211 million of the total liquidations, while short positions saw $66.34 million in forced closures.

Bitcoin and Ethereum Lead Liquidation Volume

Bitcoin recorded $57.68 million in liquidations as the dominant cryptocurrency tested key support levels. Meanwhile, Ethereum faced even greater pressure with $77.44 million in liquidated positions, suggesting particular volatility in the altcoin markets during the trading session.

Market Context and Price Action

The substantial liquidation volume indicates a period of heightened volatility and potential trend reversal across digital asset markets. The disproportionate impact on long positions ($211 million) compared to short positions ($66.34 million) suggests the market movement primarily punished bullish leveraged bets, potentially signaling a shift in short-term sentiment.

Exchange Distribution and Impact

While specific exchange breakdowns weren’t provided, major trading platforms typically see the highest liquidation volumes during such market moves. The concentration in Bitcoin and Ethereum reflects their dominant trading volumes and the prevalence of leveraged products tied to these assets.

Historical Comparison and Significance

The $278 million liquidation event represents one of the more significant deleveraging episodes in recent weeks, though it remains smaller than some historical liquidation cascades that have exceeded $1 billion during extreme market conditions. The event serves as a reminder of the risks associated with leveraged cryptocurrency trading, particularly during periods of shifting market dynamics.

Traders are monitoring whether this liquidation flush has effectively reset leveraged positions or if additional volatility could trigger further forced position closures in the coming sessions.